What is Swing Trading: A Comprehensive Guide for Investors

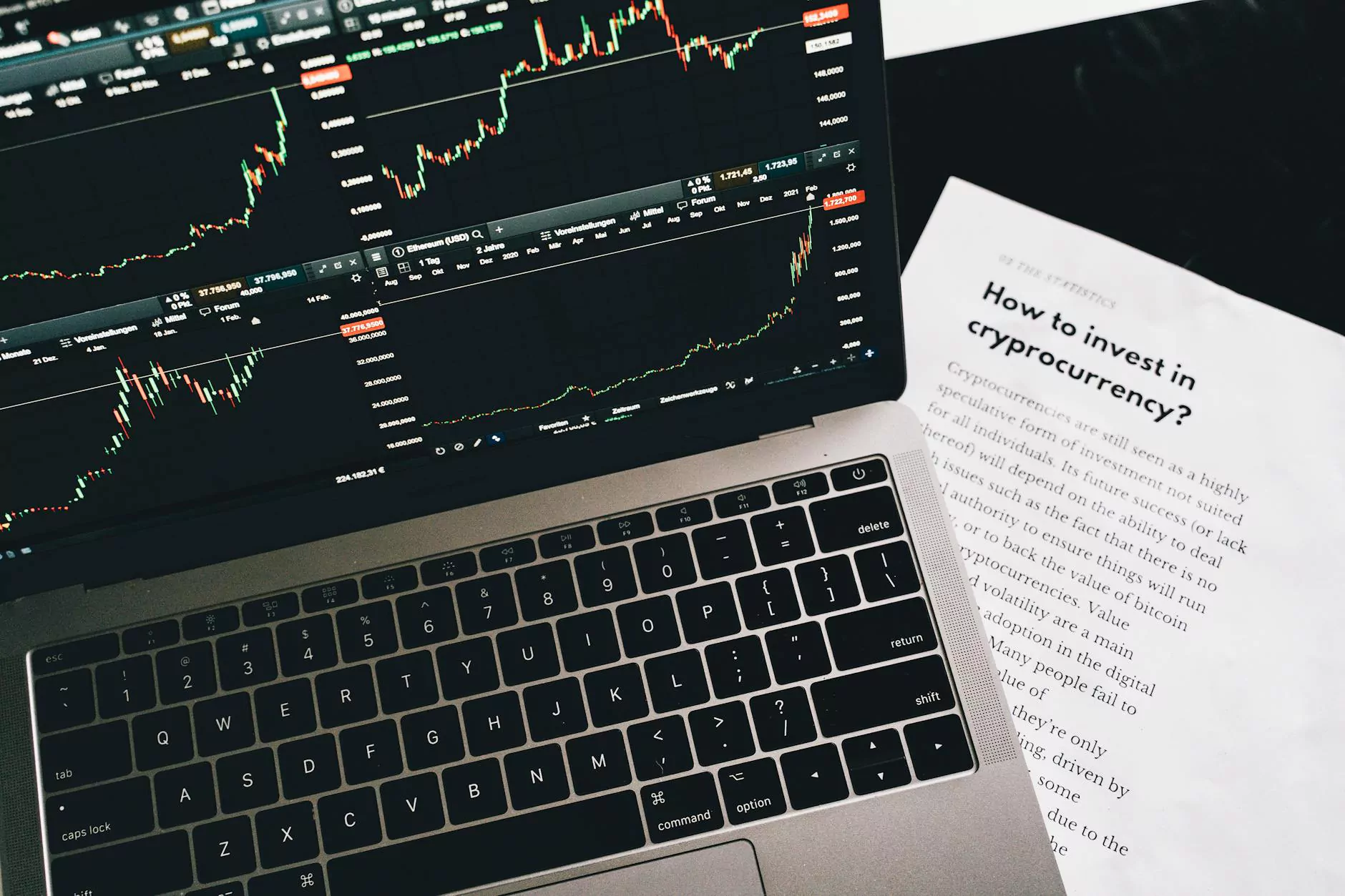

Swing trading is a trading style that focuses on capturing short- to medium-term price moves in a stock (or any financial asset). Traders typically hold positions from several days to a few weeks, aiming to profit from fleeting market momentum. In this article, we will delve deeply into the intricacies of swing trading, offering strategies, benefits, and tips that can enhance your trading arsenal.

The Basics of Swing Trading

Understanding the fundamentals is crucial before diving into any trading strategy. Here's a breakdown of the essential components of swing trading:

- Time Frame: Swing traders usually operate on daily and weekly charts, looking for price movements and trends that can be leveraged over short periods.

- Market Analysis: Swing trading relies heavily on both technical and fundamental analysis to identify potential trading opportunities.

- Risk Management: Effective risk management is key. This includes setting stop-loss orders to protect against significant losses.

Why Choose Swing Trading?

The appeal of swing trading lies in its potential for decent returns without the need for constant market monitoring. Here are several reasons why investors may find swing trading an attractive option:

- Flexibility: Swing trading can be tailored to fit various lifestyles. Traders can analyze their positions once or twice a day, rather than requiring minute-by-minute monitoring.

- Profit Potential: By capturing short-term price movements, swing traders can achieve substantial gains in relatively brief periods.

- Less Stressful: Unlike day trading, swing trading reduces the pressure of needing to execute multiple trades within a single day.

Understanding Market Trends

To succeed in swing trading, it is imperative to understand market trends. Trends are classified into three main categories:

- Uptrends: Characterized by higher highs and higher lows, indicating a bullish market sentiment.

- Downtrends: Defined by lower highs and lower lows, reflecting bearish sentiment.

- Sideways Trends: The price moves within a horizontal range, indicating indecision among traders.

Key Strategies for Swing Trading

Effective swing trading hinges on utilizing sound strategies. Here are some tried-and-true methods:

1. Technical Analysis

Technical analysis involves examining past price movements and trading volumes to predict future performance. Swing traders often use the following tools:

- Moving Averages: Helps smooth out price data to identify trends over specific periods.

- Support and Resistance Levels: Identifies price points where the asset historically struggles to pass through.

- Indicators: Tools such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) aid traders in evaluating momentum and trend strength.

2. Fundamental Analysis

Although swing trading primarily focuses on short-term price movements, understanding the underlying fundamentals is equally crucial. Important factors include:

- Earnings Reports: Awareness of upcoming earnings announcements can influence price movements significantly.

- Economic Indicators: Reports such as GDP growth rates, employment data, and inflation impact market conditions.

- News Events: Headlines can drive volatility, creating swift opportunities for swing traders.

3. Risk Management Techniques

Protecting your capital while swing trading is essential. Here are a few key techniques:

- Setting Stop-Loss Orders: Automatically closing a position once it reaches a specified loss level will help limit potential downfalls.

- Position Sizing: Determine how much of your portfolio to allocate to each trade to prevent significant losses.

- Diversification: Spreading your investments across different assets can reduce risk.

Common Mistakes to Avoid in Swing Trading

Even seasoned traders encounter pitfalls in swing trading. Here are some common mistakes to watch out for:

- Ignoring Risk Management: Failing to implement stop-loss orders can lead to devastating losses.

- Overtrading: It is tempting to make too many trades, especially during volatile periods. Quality over quantity is key.

- Emotional Trading: Making decisions based on fear or greed can lead to poor outcomes. Stick to your trading plan.

Building a Swing Trading Plan

A comprehensive swing trading plan is vital for success. Here’s how to create one:

1. Set Specific Goals

Define what you want to achieve. This could be a target profit percentage per month or the development of specific trading skills.

2. Define Your Strategy

Choose your approach based on risk tolerance, available time, and market knowledge. Document your chosen method for consistency.

3. Analyze and Adapt

Regularly review your trades to see what works and what doesn't. Adjust your strategy as needed.

Tools and Resources for Swing Traders

In the digital age, swing traders have access to an array of tools that can enhance their trading experience:

- Trading Platforms: Platforms such as E*TRADE, TD Ameritrade, and Fidelity provide tools and resources tailored to swing traders.

- Charting Software: Tools like TradingView allow traders to analyze stocks and identify patterns seamlessly.

- Financial News Websites: Staying updated on the latest market news is crucial. Websites like Bloomberg and CNBC offer real-time financial news.

Conclusion: Embrace the Swing Trading Journey

In summary, swing trading provides a compelling opportunity for those looking to capitalize on short- to medium-term market movements. By understanding what swing trading is, mastering the necessary strategies, and employing diligent risk management, you can enhance your potential for success.

As you embark on this exciting investment journey, remember that consistency and perseverance are key. Each trade you make offers a valuable learning experience that can help refine your approach. So, take your time, educate yourself, and, above all, enjoy the thrill of the market!

For more insights into financial strategies and services, visit us at BullRush.com.

what is swing trading